Can You Take Out a Loan to Build a House? Exploring Construction Loans and Their Benefits

Building your dream home is an exciting endeavor, but it often comes with significant financial considerations. Unless you have substantial savings, you may need to explore financing options to cover construction costs. One such option is a construction loan, a specialized type of loan designed specifically for building a house.

Understanding Construction Loans

A construction loan is a short-term loan provided by a financial institution, usually a bank or credit union, used to finance the construction of a new home. Unlike traditional mortgages for purchasing an already-built property, construction loans are designed to cover building costs from the ground up.

How Do Construction Loans Work?

Construction loans typically have a drawdown structure, where funds are disbursed in several stages or “draws” as the construction progresses. The lender conducts periodic inspections to ensure the work is completed as planned before releasing each draw.

The Phases of a Construction Loan

Pre-Approval: Before starting the construction loan process, borrowers must undergo pre-approval, which involves providing financial documents and meeting specific lending criteria.

Construction Contract: Once pre-approved, the borrower works with an architect and builder to create a detailed construction plan and budget. The lender will use this plan to evaluate the feasibility of the project.

Loan Application: With the construction plan and budget in place, the borrower applies for the construction loan. The lender reviews the application, including credit history, income, and the construction plan, to determine the loan amount and terms.

Loan Approval and Disbursement: The funds are disbursed in draws based on the construction stages after loan approval. The borrower only pays interest on the amount spent during the construction phase.

Conversion to a Mortgage: Once construction is complete, the construction loan is typically converted into a traditional mortgage, where the borrower begins making regular payments on the remaining loan balance.

Types of Construction Loans

There are two primary types of construction loans:

Construction-to-Permanent Loan: This type of loan combines construction financing and a long-term mortgage. It simplifies the process for borrowers by eliminating the need to refinance after construction is complete.

Stand-Alone Construction Loan: With a stand-alone construction loan, the borrower secures the financing solely for the construction phase. After construction, the borrower must obtain a separate mortgage to pay off the construction loan.

Benefits of Construction Loans

Financing for Customization: Construction loans allow borrowers to build custom homes that meet their needs and preferences.

Interest-Only Payments: During the construction phase, borrowers only pay interest on the funds disbursed, which can lead to lower initial payments.

Flexible Terms: Construction loans offer flexibility in the loan amount, repayment period, and interest rates based on the lender’s terms and the borrower’s financial situation.

Opportunity for Investment: Some borrowers use construction loans to build homes for investment purposes, intending to sell or rent the property for potential returns.

Important Considerations

Financial Preparedness: Before applying for a construction loan, it’s crucial to assess your financial readiness and ability to handle the loan’s terms, including interest rates, repayment period, and potential fluctuations in the real estate market.

Experienced Builders: Choosing a reputable and experienced builder is essential for a successful construction project. Lenders often require borrowers to work with licensed and insured builders to ensure the project’s quality and completion.

Construction Timeline: Construction delays can impact the loan’s drawdown schedule and potentially lead to increased costs. Planning a realistic construction timeline is vital for managing the loan effectively.

Down Payment: Most construction loans require a significant down payment, typically around 20% of the total project cost. Borrowers must have sufficient savings to cover this upfront expense.

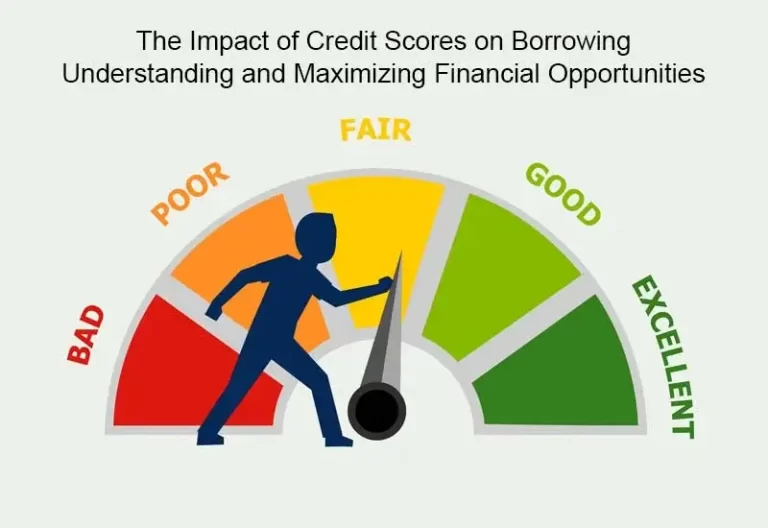

Credit Score and History: Like traditional mortgages, construction loans require a strong credit history and score to secure favorable loan terms. Borrowers with lower credit scores may need higher interest rates or help to qualify.

Conclusion

Taking out a construction loan to build a house can be an excellent option for those who desire a custom-built home and have the financial means to embark on a construction project. Borrowers can make informed decisions and embark on a successful construction journey by understanding how construction loans work, exploring the different types available, and considering important factors such as financial preparedness and experienced builders. With careful planning and financial support, building your dream home can become a reality. Work closely with reputable lenders and professionals to ensure a smooth and satisfying building experience.