Understanding the Requirements and Eligibility for FHA Loans in California

For aspiring homeowners in California, navigating the world of mortgage loans can be daunting. Through its FHA loan program, the Federal Housing Administration (FHA) offers a lifeline to many first-time buyers and those with limited financial resources. FHA loans have attractive benefits, including low down payment requirements and flexible credit score standards. This blog post will delve into the requirements and eligibility criteria for FHA loans in California, helping potential homebuyers understand how to take advantage of this government-backed program.

What is an FHA Loan?

An FHA loan is a mortgage insured by the Federal Housing Administration, a division of the U.S. Department of Housing and Urban Development (HUD). FHA loans are designed to assist moderate and low-income individuals and families achieve homeownership by providing more lenient qualification criteria than conventional loans.

FHA Loan Benefits

Before diving into the eligibility requirements, let’s explore some of the key benefits of FHA loans:

Low Down Payment: One of the most significant advantages of FHA loans is the low down payment requirement. Borrowers may qualify with a down payment as low as 3.5% of the home’s purchase price.

Flexible Credit Score Standards: FHA loans are accessible to borrowers with credit scores that may not meet conventional loan requirements. While specific credit score thresholds may vary among lenders, FHA loans generally accommodate borrowers with lower credit scores.

Fixed and Adjustable-Rate Options: FHA loans offer fixed-rate and adjustable-rate mortgage options, allowing borrowers to choose the best fit for their financial situation.

Streamlined Refinancing: FHA loans also offer streamlined refinancing options, making it easier for borrowers to take advantage of lower interest rates without extensive documentation.

FHA Loan Requirements and Eligibility Criteria

To qualify for an FHA loan in California, borrowers must meet specific requirements set forth by the FHA. Here’s a comprehensive overview of the eligibility criteria:

Citizenship or Legal Residency

Borrowers must be U.S. citizens, permanent or non-permanent residents with valid work visas or other relevant documentation.

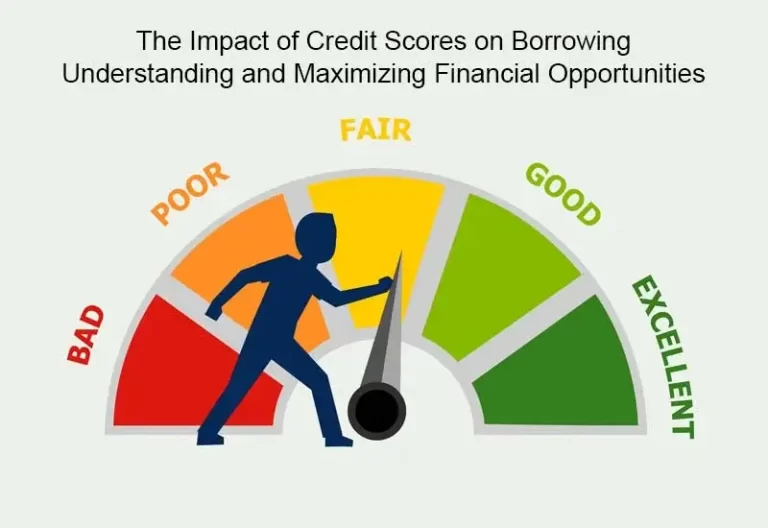

Minimum Credit Score

While FHA loans are known for their flexibility regarding credit scores, most lenders require a minimum credit score 580 to qualify for the 3.5% down payment option. Borrowers with credit scores below 580 may still be eligible but likely need to provide a larger down payment, typically 10% of the purchase price.

Debt-to-Income Ratio (DTI)

The FHA limits the debt-to-income ratio, the percentage of a borrower’s gross monthly income that goes towards debt payments. Generally, the DTI ratio should not exceed 43% of the borrower’s income.

Employment and Income Verification

Borrowers must provide proof of stable employment and income to demonstrate their ability to meet mortgage payments. Typically, lenders require at least two years of steady employment or income history.

Property Eligibility

FHA loans are intended for owner-occupied properties, so borrowers must intend to use the home as their primary residence. The property must also meet specific FHA appraisal guidelines to ensure it meets safety and livability standards.

Mortgage Insurance Premium (MIP)

FHA loans require borrowers to pay mortgage insurance premiums (MIP). The upfront MIP can be rolled into the loan amount, and borrowers will also pay annual MIP, which is added to their monthly mortgage payments.

Bankruptcy and Foreclosure History

Borrowers who have experienced bankruptcy or foreclosure may still be eligible for an FHA loan but must meet specific waiting period requirements. Typically, borrowers must wait at least two to three years after bankruptcy and three to seven years after foreclosure.

No Outstanding Federal Debt

Borrowers must not have any outstanding debt to the federal government, such as delinquent student loans or tax liens.

How to Apply for an FHA Loan in California

Pre-Qualification

The first step in the FHA loan application process is pre-qualification. Potential homebuyers can contact FHA-approved lenders and provide basic financial information to determine their eligibility and the loan amount they may qualify for.

Gather Documentation

Borrowers will need to gather relevant documentation, including pay stubs, W-2s, tax returns, bank statements, and proof of residency, to support their loan application.

Loan Application

Once borrowers have selected a lender and gathered all necessary documents, they can formally apply for the FHA loan. The lender will review the application and supporting documents to determine the borrower’s eligibility.

Property Appraisal

As part of the loan process, an FHA-approved appraiser will evaluate the property to ensure it meets the FHA’s safety and livability standards.

Underwriting and Approval

After the appraisal and thoroughly reviewing the borrower’s financial situation, the lender will underwrite the loan and make a final approval decision.

Closing and Funding

If the loan application is approved, the final step is the closing process, during which the borrower signs the necessary documents and the loan is funded.

Conclusion

FHA loans present an excellent opportunity for many Californians to achieve homeownership, particularly for first-time buyers and those with limited financial resources. With low down payment requirements, flexible credit score standards, and other borrower-friendly features, FHA loans offer a pathway to homeownership accessible to a broader range of individuals and families. By understanding the requirements and eligibility criteria for FHA loans in California and working with an experienced FHA-approved lender, potential homebuyers can confidently navigate the process and turn their dream of homeownership into reality.