The Importance of Personal Finance Education for Kids: Setting the Foundation for Financial Success

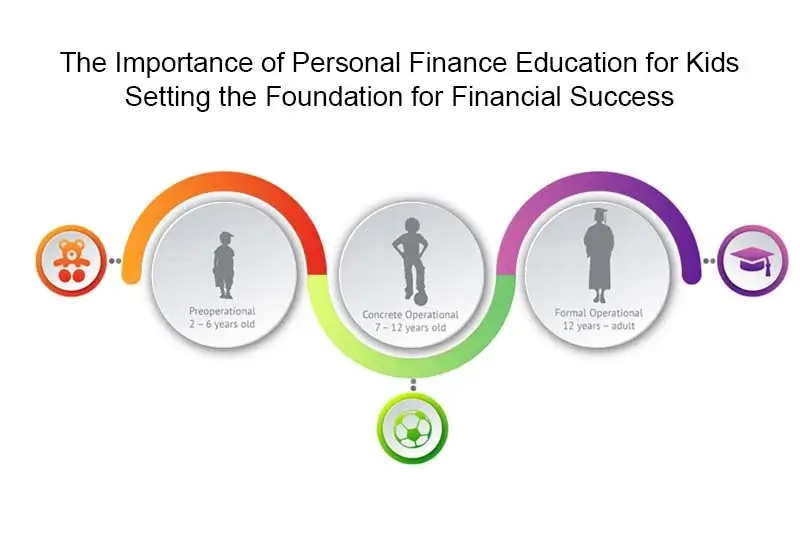

In today’s rapidly evolving world, personal finance education has become essential to preparing children for a successful future. Teaching kids about money management and financial responsibility from an early age lays the groundwork for a lifetime of smart financial decisions.

Financial literacy is the understanding of basic financial concepts and the ability to apply that knowledge to make informed financial decisions. By introducing personal finance education at a young age, children develop a solid foundation in financial literacy, enabling them to grasp concepts such as budgeting, saving, and investing.

Cultivating Responsible Money Habits

Teaching kids about money management cultivates responsible money habits from an early age. Concepts like distinguishing between needs and wants, setting savings goals, and making wise spending choices, become ingrained in their behavior, leading to better financial decisions as they grow older.

Developing Long-Term Planning Skills

Personal finance education fosters the ability to think ahead and plan for the future. Kids learn the importance of setting financial goals, whether it’s saving for a toy, a college fund, or a future business venture. Learning to create and follow a financial plan empowers them to envision and work towards their dreams.

Understanding the Value of Money

Understanding the value of money goes beyond knowing the dollar amount. Personal finance education teaches kids about earning money through hard work, saving to afford desired items, and making thoughtful financial choices.

Building Confidence and Independence

Children develop confidence and independence as they gain financial knowledge and learn to manage their money. They become more capable of making financial decisions independently, preparing them for financial autonomy as adults.

Teaching Budgeting and Expense Management

Budgeting is a fundamental aspect of personal finance education. Kids learn how to allocate their money wisely, prioritize their spending, and avoid wasteful habits. These budgeting skills serve as valuable tools throughout their lives.

Instilling the Value of Delayed Gratification

Personal finance education emphasizes the value of delayed gratification. Kids understand that saving for a goal may require patience and discipline, fostering a sense of accomplishment when they achieve their desired outcome.

Preparing for Real-World Financial Challenges

As children grow into adulthood, they will face various financial challenges, from managing credit and debt to making major purchases and planning for retirement. Personal finance education equips them with the knowledge and skills to navigate these challenges confidently.

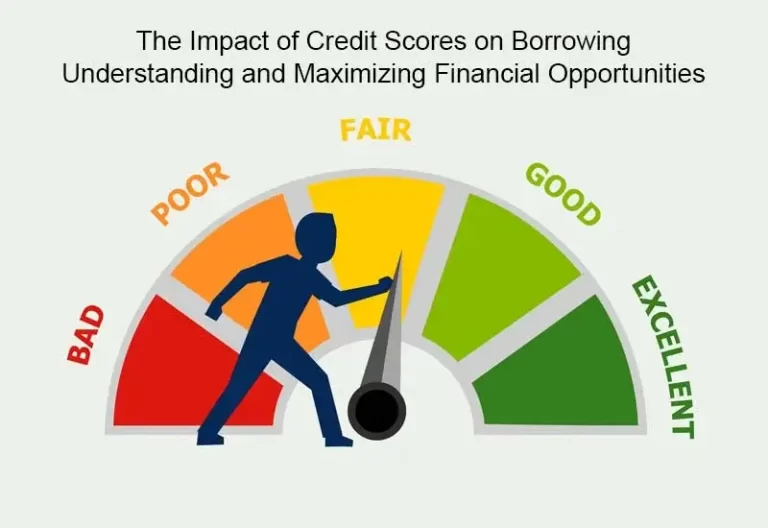

Avoiding Debt Traps

Understanding the consequences of debt and its potential impact on their financial future empowers kids to make responsible credit decisions. Learning about debt early on can help them avoid falling into debt traps later in life.

Fostering Open Conversations About Money

Personal finance education opens the door for parents and educators to have open conversations about money with kids. These discussions help remove the taboo around money matters, encouraging kids to seek advice and guidance when needed.

Conclusion

The importance of personal finance education for kids cannot be overstated. By instilling financial literacy, cultivating responsible money habits, and teaching valuable financial skills, children are better prepared to handle the financial challenges of adulthood. Personal finance education sets the stage for financial success and promotes a sense of confidence, independence, and responsibility in kids as they grow into financially capable adults. Start early, engage in open conversations, and watch as your children embrace the principles of smart money management, setting themselves on a path to a financially secure future.